If 2024 was the year of quiet luxury, 2025 was undeniably the year of economic turbulence.

We’re seeing major economic shifts that are changing everything about how people discover and buy products.

What started it? A change in trade laws that is causing chaos for suppliers everywhere.

For years, the resale market has been positioned as a sustainability play, a way for brands to align with ESG goals and capture the ever growing share of eco-conscious Gen Z shoppers.

However, data from the ThredUp 2025 Resale Report revealed a starkly different reality: resale is no longer just a “green” choice; it is an economic necessity.

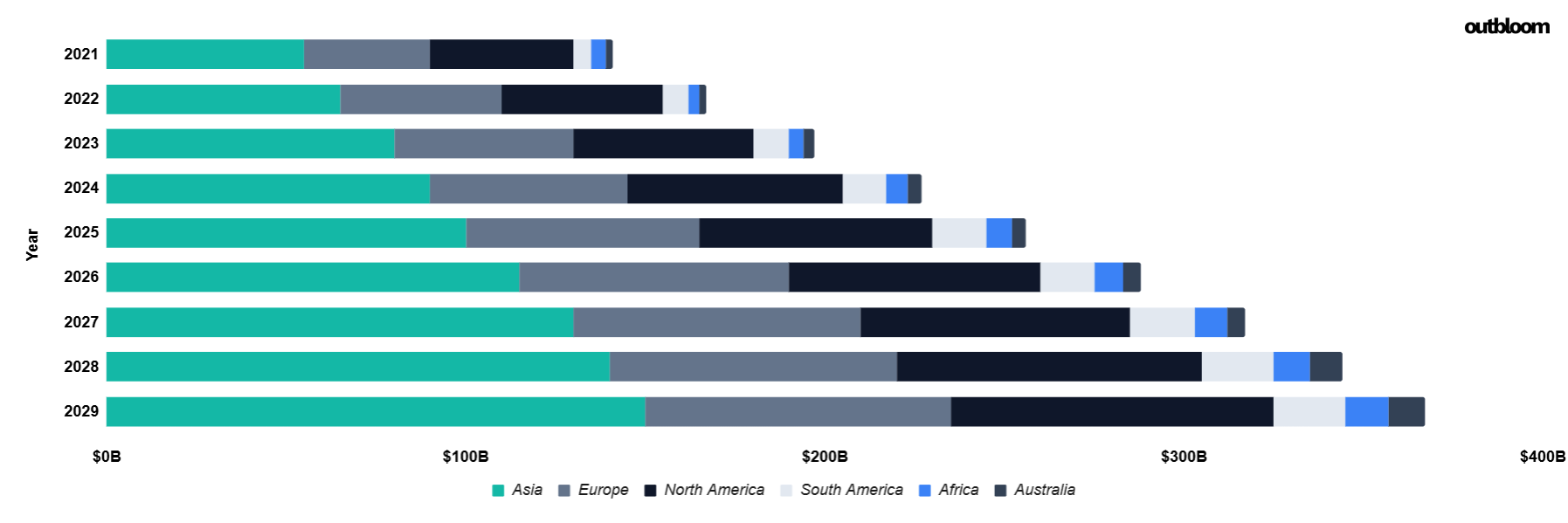

With the global secondhand apparel market projected to reach £268 billion ($367bn) by 2029, we are seeing the emergence of resale as a critical economic buffer against inflation.

(Source: ThredUp Resale Report 2025)

For performance directors and brand managers, understanding this shift is key to navigating the 2026 retail landscape and this post addresses why the tariff hedge is the most important trend in fashion retail this year.

A Price Squeeze on Traditional Retail

To understand the consumer pivot to resale, we must first look at the friction in the primary market (e.g. regular run of the mill fashion).

New tariffs in 2025 immediately made clothing more expensive to produce, squeezing an industry that relies on importing goods and the numbers are eye opening.

According to recent analysis by the Yale Budget Lab, the average effective U.S. tariff rate has climbed to approximately 22.5%, the highest level since 1909.

Fashion brands aren’t just feeling a pinch, they’re taking a direct hit. We’re looking at a 17% price hike on clothes under these new rules and the price shock is filtering down to the consumer almost immediately.

The National Retail Federation (NRF) has reported that consumers are feeling “anxious and confused” regarding these policy shifts, with retail sales growth projections slowing to between 2.7% and 3.7% for the year.

In a landscape where the cost of “new” is rising faster than wages, the value proposition of traditional retail is being eroded.

Seeking Shelter in the Secondary Market

When the price of new goods skyrockets, consumers do not necessarily stop shopping, they change where and how they shop.

And what’s most interesting is that the friction in the primary market (new goods) is acting as a massive acquisition channel for the secondary market (resale).

ThredUp’s latest data highlights a staggering behavior change: 59% of consumers explicitly state they will turn to secondhand apparel as a buffer against rising prices caused by tariffs.

This is a majority behavior, signaling that resale has graduated from a niche hobby to a mainstream financial strategy and we are seeing this across the broader retail sector too.

A 2025 consumer insight report from the Goodman Group noted that 72% of consumers are actively concerned about the rising cost of essentials, leading 57% to conduct significantly more research before making a purchase.

This shift is even more pronounced in the UK and Europe with Barclays’ Consumer Spend Report indicating that 46% of adults are planning to reduce their discretionary spending in 2026 to manage household finances.

Reducing spend does not mean exiting the category, instead, it drives volume toward lower basket values, specifically, resale marketplaces where premium goods can be acquired at a fraction of the tariff-inflated retail price.

The ‘Value-First’ Mindset Over ‘Values-First’

For the past five years, brand messaging in Fashion has heavily leaned on: values, sustainability, ethics, and circularity.

While these remain important, data suggests that value (price/quality ratio) is the dominant driver (no surprise?).

Shoppers are treating their clothes like investments.

ThredUp found that 49% of consumers have cut back on buying cheap, lower-quality apparel specifically because it has no resale value, an incredibly unique reason that wouldn’t have even been considered a decade ago.

People are thinking ahead, planning how much cash they can get back for an item before they even take the tags off, and this doesn’t just apply to items over a certain value, it’s across everything, from Uniqlo T-Shirts to Birkins.

Findings from PwC’s 2025 Trends in Luxury Fashion notes that while Gen Z and Millennials are driving the secondhand boom, price sensitivity is paramount.

Roughly 29% of luxury consumers admit to waiting for sales or turning to the secondary market when prices for new collections become prohibitive.

The term “used” has a completely different stigma in 2026, and terms such as “pre-owned” and “pre-loved” are front and centre.

Retailers Are Domesticating The Supply Chain

Perhaps the most critical insight is how retail executives are reacting to this volatility.

For decades, the industry depended on making things cheaply overseas. Now that that system is broken, resale offers a fix: a supply chain that stays right here at home.

Resale stock is already here, sitting in people’s closets, safe from new taxes and shipping delays, and the data backs it up:

- 54% of retail executives now view resale as a more reliable source of goods amidst trade disruptions.

- 44% are actively looking to reduce their reliance on imported goods by leaning into resale programs.

Brands are realising that by launching a branded resale program (or ‘Recommerce’), they can generate revenue from inventory that has already been imported, sold, and worn.

It is a way to monetise the same asset twice, without paying a second tariff.

Strategic Takeaways

The tariff hedge is not a marketing tactic, it is a fundamental shift in retail unit economics.

For 2026, we are advising brands and agencies to elevate resale ‘nice-to-have’ to a core pillar of branding, messaging, paid media, and more:

- Exit Prices – Shoppers are now calculating the “exit price” before they even pay the entry price. Consumers need to know how much value they retain once pulling the trigger and buying new to justify the purchase.

- The Total Cost of Ownership – With the price of ‘new’ increasing, the consumer definition of value has shifted from low price to high yield. Brands must pivot their positioning to highlight asset value. Marketing narratives can lean into “investment quality” of the primary product, even communicating that buying new is a safe financial decision because it retains 40-50% of its value (for example).

- The First Search – The data confirms that for 48% of younger consumers, secondhand is the first search. The strategy for 2026 is to utilise resale as an efficient customer acquisition tool. By capturing price-sensitive shoppers in the secondary market today, you bring them into your ecosystem, capture their data, and nurture them into full-price buyers or maintain a steady stream of income from repeat secondhand purchasing.

The secondary market has graduated from an eco-initiative to a financial imperative.

In a landscape where trade policy is rewriting the rules of profitability, resale is the only sector projected to grow 2.7 times faster than the global apparel market by 2029.

———-

Want to chat more about resale fashion? We’d love to catch up.